Gwinnett County, Georgia

Georgia mortgage help in Gwinnett County: foreclosure, divorce, and loan modification options

If you’re searching for Gwinnett County mortgage help, you might be behind on payments, dealing with divorce, or worried about foreclosure. This guide breaks down your options in plain English and helps you

take the next step with a clear plan.

Quick links:

- How foreclosure works in Georgia

- Late mortgage payments: first steps

- Loan modifications

- Divorce and the mortgage

- Selling before foreclosure

- Avoiding scams

- FAQ

Most people don’t fall behind because they were careless. It’s usually a big life change or a slow squeeze over time.

The important thing is not waiting too long to respond, because Georgia mortgage help in Gwinnett County

is often about timing. Acting early usually means more choices.

Local note: This post is written for Gwinnett County homeowners, including

Lawrenceville, Duluth, Suwanee, Norcross, Snellville, Lilburn, and Peachtree Corners.

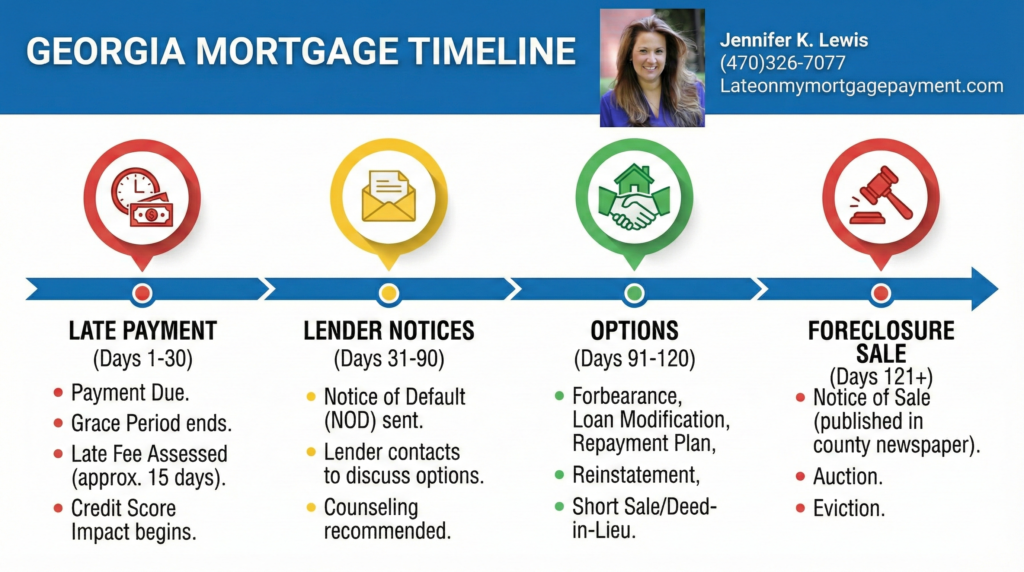

Georgia mortgage help in Gwinnett County: how foreclosure works

Georgia is often described as a non-judicial foreclosure state in many situations, which can mean

the process moves quicker than people expect. If you are getting certified letters, notices, or anything referencing a sale date,

don’t ignore it.

Helpful resources (external links):

- Georgia Attorney General: Mortgage and Foreclosure Information —

consumer overview and FAQs - Georgia Code (notice timing, O.C.G.A. § 44-14-162.2) —

30-day notice requirement before the proposed sale date

Quick reality check: If you received a notice with a sale date, treat it like a real deadline.

Your options are usually better before a sale date is set.

Georgia mortgage help in Gwinnett County for late mortgage payments

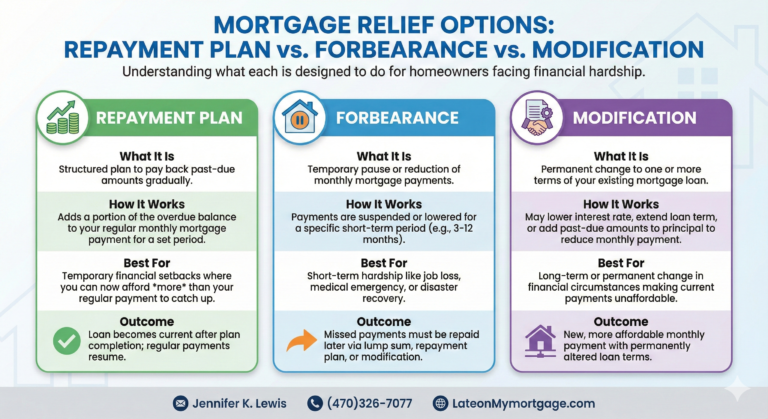

If you’re behind, start by calling your mortgage servicer and asking for the loss mitigation department.

Ask what options are available and what documents they need. Keeping a simple folder of paperwork can make the process smoother.

- Repayment plan: catch up over time by adding a set amount to future payments

- Forbearance: temporarily pause or reduce payments, then resume later

- Loan modification: adjust loan terms to reduce the monthly payment long-term

Need support? Find a HUD-approved housing counselor here:

CFPB housing counselor locator

Georgia mortgage help in Gwinnett County with loan modifications

A loan modification is not a refinance. It means your lender adjusts your current loan terms to make the payment more affordable.

For homeowners seeking Georgia mortgage help in Gwinnett County, a modification can be a strong option if your income is stable again.

What usually helps: a clear hardship explanation, stable current income, and complete documents.

Many denials happen because paperwork is missing or late.

Georgia mortgage help in Gwinnett County during divorce

Divorce is a common reason homeowners fall behind because one household becomes two and the budget shifts fast.

Important: a divorce agreement can assign responsibility between spouses, but it doesn’t automatically change the mortgage contract.

Most common paths:

- One spouse keeps the home: usually requires refinancing into one name (or an approved assumption if allowed)

- Sell the home: often the cleanest way to avoid future missed-payment surprises

- Temporary co-ownership: can work with a written plan and a clear deadline

Georgia mortgage help in Gwinnett County: selling before foreclosure

Sometimes the best move is to sell before the situation escalates. If the payment isn’t realistic long-term,

selling early can preserve options and reduce stress. In Gwinnett County, strategy matters neighborhood by neighborhood.

Serving Gwinnett’s biggest areas: Lawrenceville, Duluth, Suwanee, Norcross, Snellville, Lilburn, Peachtree Corners.

Related reads :

Gwinnett foreclosure & mortgage help |

Georgia short sale guide |

Divorce and the house in Georgia

Georgia mortgage help in Gwinnett County: watch out for scams

When someone is behind on payments, scam calls and mailers often increase. Be cautious of anyone who guarantees results,

pressures you to sign quickly, or asks for large upfront fees.

Plain-language legal info:

Georgia Legal Aid foreclosure resources

.

FAQ: Gwinnett County mortgage help

Can I do a short sale in Gwinnett County if I’m behind?

Sometimes, yes. A short sale typically requires lender approval, and the home is priced based on the market rather than what’s owed.

The earlier you explore it, the more control you usually have.

Should I pursue a loan modification or sell?

Start with the budget. If the home is affordable with a realistic payment, modification may make sense. If it isn’t,

selling can be the cleaner path.

What should I do first if I got a notice?

Call your servicer and ask for loss mitigation. Gather your documents. If the notice includes a deadline or sale date, act quickly.

Talk through your timeline

If you need Georgia mortgage help in Gwinnett County and you’re not sure whether to pursue a modification, sell,

or take another option, I can help you map out realistic next steps.

Jennifer K. Lewis • (470) 326-7077 • Lateonmymortgage.com

Disclaimer: This article is for general education and is not legal or financial advice. Every loan and timeline is different.