Save Money on your Gwinnett County Tax Bill

You will need some information in order to file. Often times you can use your closing statement, if you have recently purchased your home it should be easy to get. If you do not have it you can ask your closing agent, or closing attorney. You will need it to file your income taxes anyway.

What’s the Process?

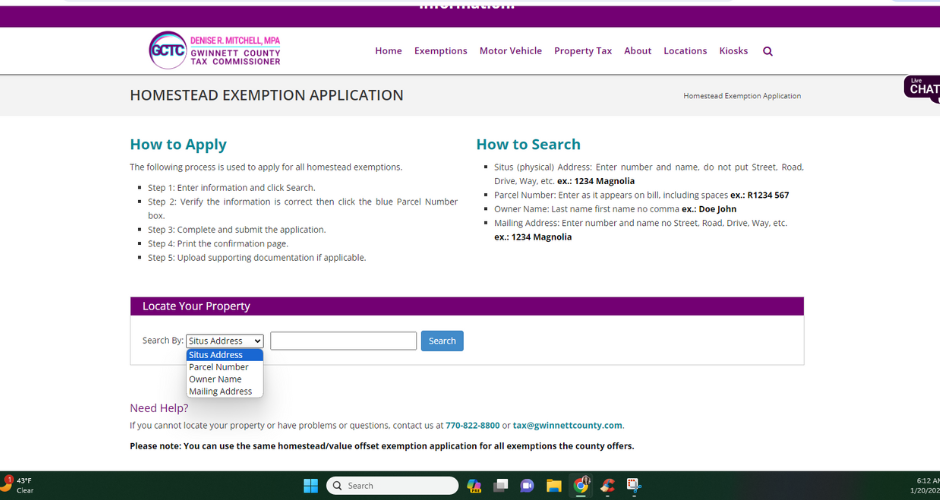

The process to file your homestead is relatively simple. Click here for the link; Homestead Exemption Application https://gwinnetttaxcommissioner.publicaccessnow.com/HomesteadExemptionApplication.aspx

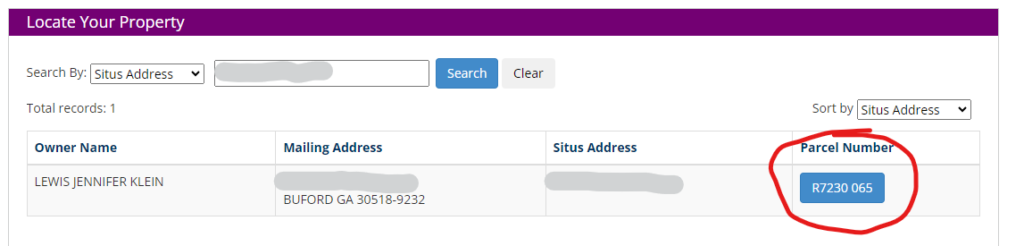

You will need one of 4 things in order to start the application on line: Owner name, situs name, parcel number, or mailing address. Once you’ve located that this box will appear with your parcel #.

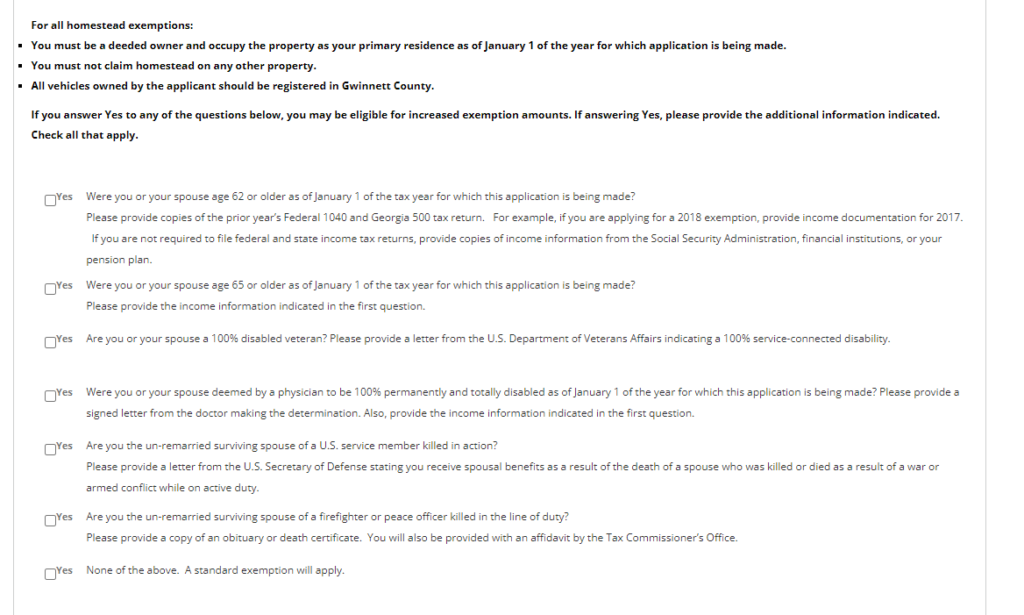

Click on the blue button, it’s going to ask you if you own and occupy the property and to click “here.” Then it will ask you a bunch of questions about your purchase date, spouse info etc. At the bottom it will as you these questions, so be prepared.

Extra questions on Homestead Application which may get you more exemptions.

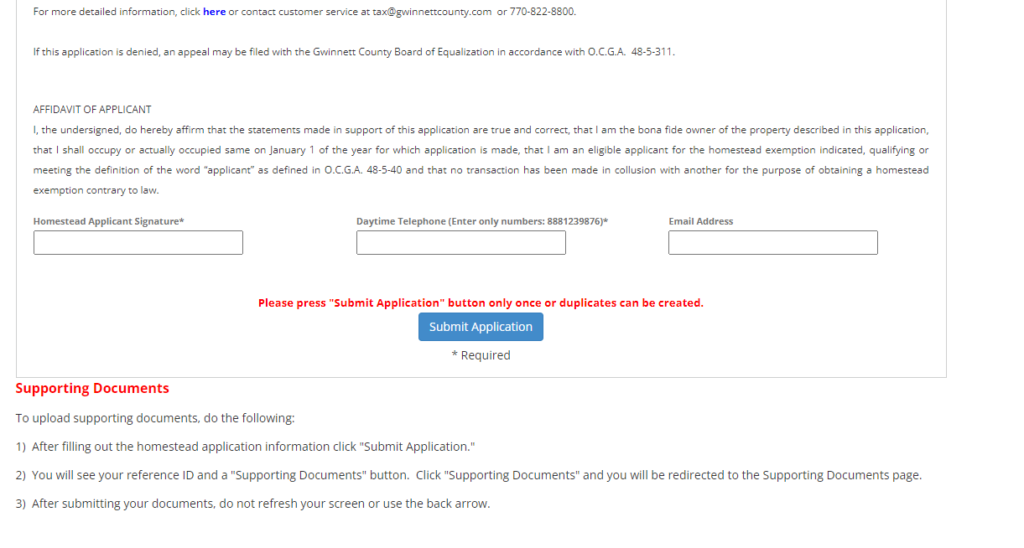

At the bottom it will as for your digital signature and affidavit.

For supporting documentation you can upload your closing statement or any other materials you deem necessary.

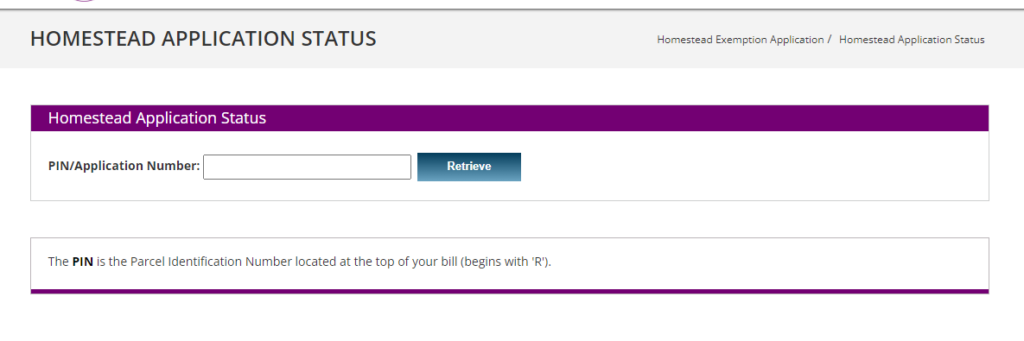

You can check the status of your homestead application right on the website.

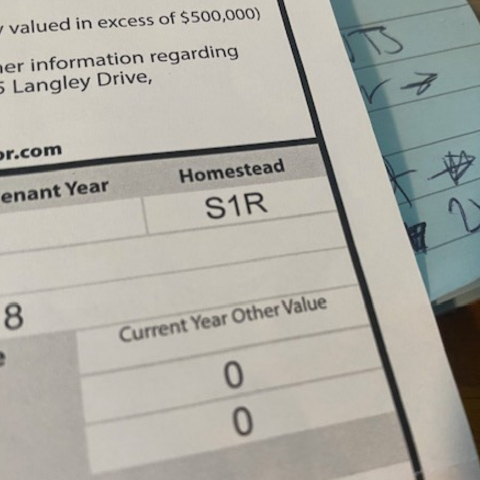

When you get your property tax bill it’s important to verify that your Homestead exemption does apply. Here’s what it will look like

S1R – Regular Homestead Exemption

-

- No age or income limit.

- For all property owners who occupy the property as of January 1 of the application year.

- Includes $10,000 off the assessed value on County, $4,000 off school, and $7,000 off recreation.

Congratulations, now sit and enjoy the tax benefits of homeownership! So, if you find that your tax bill increases give me a call, I can help you fight your assessed value and have a lot of success doing so. (470)326-7077.

How to file your Homestead Exemption in Hall County

How to file your homestead exemption in Barrow County

How to file your homestead exemption in Fulton County

How to file your homestead exemption in Jackson County

How to file your homestead exemption in Paulding County</p

How to file your Homestead exemption in Forsyth County

CLICK HERE for Other Exemptions you may find Helpful

If you know of anyone buying or selling a home or land please have them contact Jennifer K. Lewis.