Repayment Plan vs. Forbearance in Georgia: Gwinnett County Mortgage Help for Late Payments

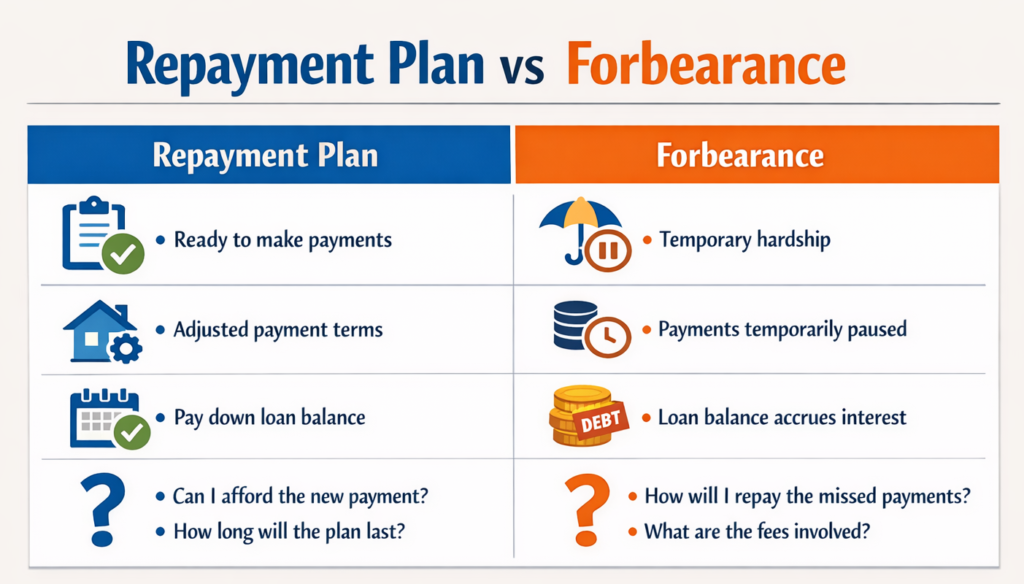

If you’re behind on your mortgage and searching for Gwinnett County mortgage help, you’ll usually hear two early options from your servicer: a repayment plan or a forbearance. They sound similar, but they work very differently. Choosing the right one depends on your timeline and whether your income is stable again.

Related: Start with the Gwinnett overview here:

Gwinnett County Mortgage Help (Foreclosure, Divorce & Loan Modification Options)

What is a repayment plan?

A repayment plan is a structured way to catch up on missed payments by adding a set amount to your regular monthly payment for a period of time. Your servicer spreads the past-due amount out so you can bring the loan current without paying everything at once.

A repayment plan is usually a better fit when:

- Your income is back to normal (or close to it)

- The hardship was temporary

- You can afford a higher payment for a short window

What is forbearance?

Forbearance is temporary relief. Your servicer may pause payments or reduce them for a set period, and then you resume regular payments afterward. Forbearance can be helpful when your hardship is still happening and you need breathing room.

Forbearance is usually a better fit when:

- You’re still in the middle of the hardship (job change, medical event, divorce transition)

- You need short-term relief to avoid falling further behind

- You expect the situation to improve within months

Repayment plan vs forbearance: the real difference

The simplest way to think about it:

- Repayment plan = catch up while paying your normal payment, plus extra

- Forbearance = pause or reduce now, then deal with the missed amount later

Important: Always ask how the missed payments will be handled at the end of forbearance. The details matter.

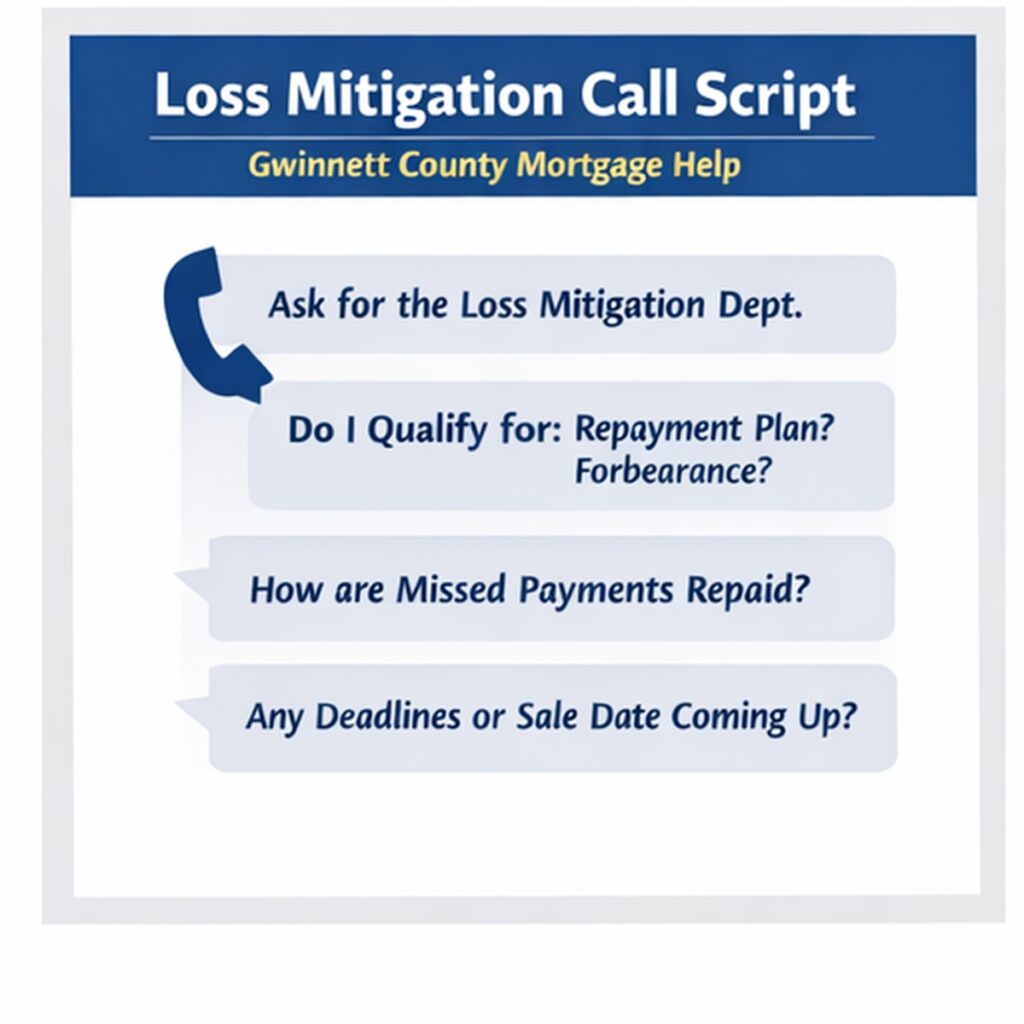

What to ask the loss mitigation department (copy these questions)

- What option do I qualify for right now: repayment plan, forbearance, or loan modification?

- If I take forbearance, what happens at the end? Do I repay in a lump sum, add it to the loan, or enter a repayment plan?

- If I take a repayment plan, what will my monthly payment be during the catch-up period?

- Are there any deadlines or notices I should know about right now?

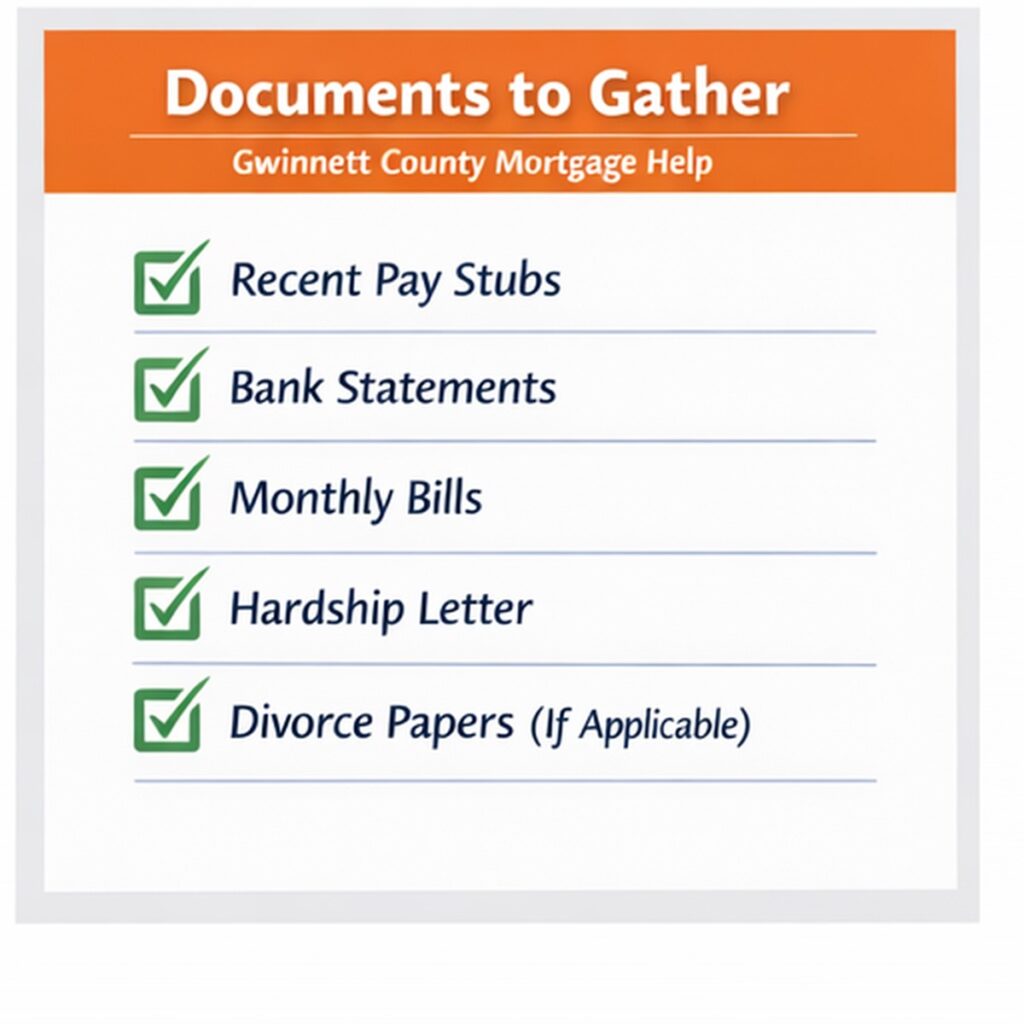

- What documents do you need from me, and where should I upload them?

When to consider loan modification instead

If the payment is not affordable long-term, a repayment plan may not solve the real problem. That’s when homeowners start exploring a loan modification, which changes the loan terms to lower the payment over time.

Next step reading: Loan Modification in Georgia (Plain-English Guide)

Need help choosing the right option in Gwinnett County?

If you’re behind on payments and not sure whether a repayment plan, forbearance, modification, or selling is the better move, I can help you map out the next steps based on your timeline.

Call or text: Jennifer K. Lewis (470) 326-7077

Website: LateOnMyMortgage.com

Disclaimer: This article is for general education and is not legal or financial advice. Every loan and timeline is different.