Do you think you should qualify for down payment assistance in Georgia or the Georgia Dream Home Loan? Or FHA, also known as, first time home buyer program? What are the qualifications? how do you qualify and are they REAL? Do people really qualify for them? How much do they cost? Do you have to pay them back? What’s the catch? Loan officer, Kim Schoning with Capital City Home Loans and Buford Area Realtor Jennifer K. Lewis, Exp Realty LLC, discuss the TRUTH about home loans and down payment assistance programs. Also debunk the FHA myth of first time home ownership. +REAL++++ SOLUTIONs TO RISING INTEREST RATES! To contact either with your specific needs you can more from Jennifer at JenniferInGeorgia.com or (470)326-7077 or Kim Schoning at (404)849-6086.

Georgia Dream Home loan

Georgia Dream home loan and down payment assistance has income limits. They are county specific so you will need to talk with Kim regarding your specific county. Per the DCA website here is the information:

If you purchase in one of these Georgia counties, the purchase price cannot exceed $325,000: Barrow, Bartow, Carroll, Cherokee, Clayton, Cobb, Coweta, Dawson, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Heard, Henry, Jasper, Morgan, Newton, Paulding, Pickens, Pike, Rockdale, Spalding or Walton

Household income cannot exceed:

- 1 or 2 persons: $84,000

- 3 or more persons: $96,000

For any county not listed above, the purchase price cannot exceed $275,000.

Household income cannot exceed:

- 1 or 2 persons: $72,000

- 3 or more persons: $83,000

- The hard part is finding a home for $325K in those counties! AND they are charging you 2% FEE!!! AND YOU HAVE TO PAY IT BACK!

Federal Home Loan Bank

Kim mentions Federal Home Loan Bank or FHLB as a more frequently used down payment assistance program or Affordable Housing program. It is forgiven after 5 yrs however, the income limits are also quite low. You can get $7500 down payment and closing cost assistance. If you are a community worker; health care, education, police or fire you can get $10,000 and it’s forgiven after 5 years at 20% per year. Income limits vary by county for a family of 3 in Gwinnett county it’s $76,000/yr. Please consult a professional for more information on the specifics of your income etc.

FHA OR federal housing administration

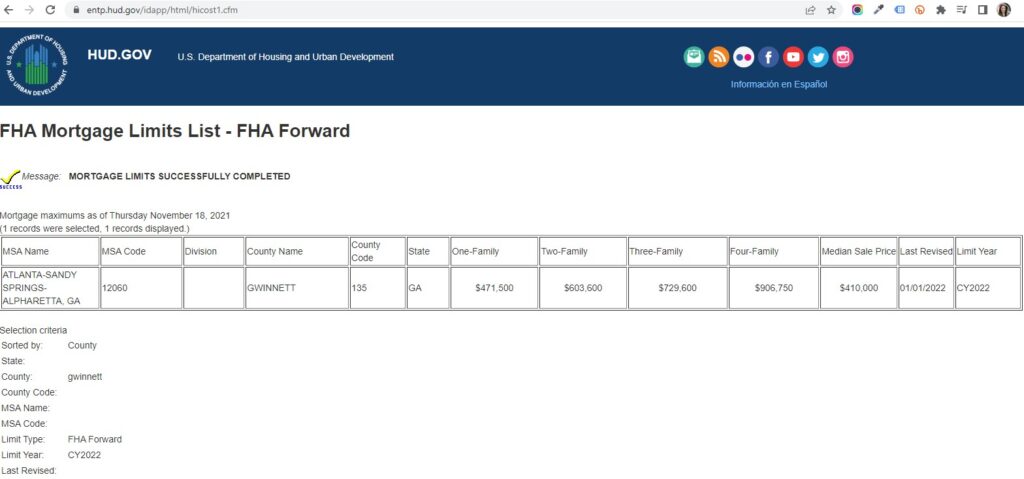

One of the biggest misnomers in lending is the FHA loan or “first time home buyers” loan. FHA doesn’t even stand for first time home buyer! In reality FHA is a Federal Housing Administration or government backed loan that caters toward first time home buyers. BUT the truth is you could have bought 5 homes and still use this “first time home buyer” program! This loan is backed by Housing and Urban Development or HUD. One of the main reasons this program is so widely used is because of the down payment requirement. This loan only requires 3.5% down. This is 3.5% of the purchase price. So, if you are buying a $400,000 home your minimum down payment is $14,000 Vs a conventional loan that requires a minimum of 5% down or more widely used with 20% down. You can check loan limits based on your county here. https://entp.hud.gov/idapp/html/hicostlook.cfm, for Gwinnett county it’s $471,500 per the website.

It’s important to know there are additional guidelines for appraisal etc. for health and safety measures with FHA as well. Which is why some sellers may opt for a conventional loan. But that’s an entirely different topic!

what’s the solution? what does work???

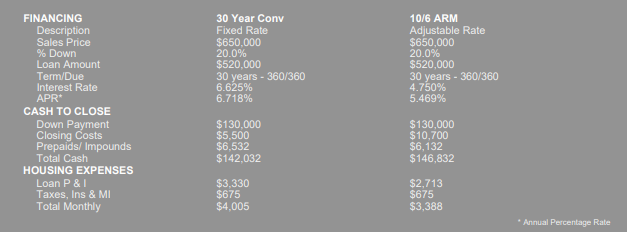

Kim mentions a program Capital City Home Loans is offering. It’s fixed for 10yrs. Now I don’t know about you, but I keep hearing people say, I’ll wait until rates come down! Well how long will that be? 10 yrs? So this may be the perfect loan to get you into a home successfully and affordable. It does require 10% down. But it can save you monthly. Here’s an example:

No matter what you choose to do. The fact is interest rates won’t be back to where they were possibly ever. As a matter of fact the fed predicts even further interest rate hikes before the end of the year. So, if you are renting at 100% interest, you may consider working with a professional to buy a home you can afford in an area you can see yourself for 5-10 yrs. Then no matter what happens with the market, you are comfortable. You can always call me Jennifer K. Lewis, (470)326-7077 or email me Jennifer@JenniferInGeorgia.com

RECENT BLOG POSTS:

Buford Homes Hidden Treasures, Georgia home inspections pass or fail?, Georgia Rent to own homes, Warbington Farms, One of a kind Georgia Pool house with Grotto, Buford Area Farmers Markets, 4 Things you must know before buying new construction in the Buford Area, Tchin Tchin Coffee & Market update, Sol Y Luna, Market Update January 2022 Metro Atlanta, Northeast Atlanta Metro Average Home Sales prices, Same as Cash offer, Beware when registering your car in Georgia, Georgia Housing Market Crash 2021, Cost comparison California vs. Georgia, The Best Bakery In Buford, The Baking Grounds, Buford Area Pumpkin Patches, Tools for moving to Suwanee, Tools for Moving to Sugar Hill, Tools for moving to Buford, Ga, Buford, Ga housing market update June 2022