When buying a home in Georgia it’s important to understand the process, especially if you are coming from out of state. Georgia is an attorney state and it makes the process and laws to closing different than an escrow state like California. One thing that makes the process in Georgia more affordable is title insurance. Attorney Marianne Shaver, from Shearer & Associates discusses with me the differences from an attorney’s standpoint.

HOW DO YOU CLOSE on your home and take possession IN GEORGIA VS CALIFORNIA?

Georgia is a “pass paper” state. So when you sign, you sign in an attorney’s office, typically with the seller across the table and you “pass the paper” for each other’s signatures. It’s a great time to exchange utility information, garbage day pick up and any history on the house etc. You sign your loan docs, fund and receive keys all at the same time. Where as, in California you typically sign a few days before actual closing. The lender clears conditions and they release funds, you receive keys to your home upon receipt of recording from the county recorder.

how do you handle out of state signers in georgia? can we sign out of state?

If you are buying a home in Georgia but you live out of state and want to sign out of state there are a few hoops you must jump through. You must accommodate a “mail away” signing of your loan documents. You must sign in the presence of an attorney in that state that is willing to sign a special notary form required by the state of Georgia called a Hancock Acknowledgement. The Georgia notary form says “signed, sealed in the presence of a witness and a notary” and must be signed with an attorney in California if that’s where you are.

With this method it’s important to consider timing. If you are scheduled to close on a specific date you will need to account for the mail, the signing and the attorney review in the state of Georgia.

Any other way to buy a home from out of state?

An alternate method might be to use a Power of Attorney to close in Georgia, ideally a family member or trusted friend. I’ve heard of cases where an agent or even the closing attorney has power of attorney for the buyer. In my opinion, that is a conflict of interest, because they have a vested interest in the deal closing. This person will basically be YOU for the signing. There is a document that must be notarized prior to signing. It must be given and authorized by the closing attorney as well. Ultimately, everything else happens the same; you sign, fund and get keys. This will allow you time to drive your stuff into your new home!

why is it an attorney state?

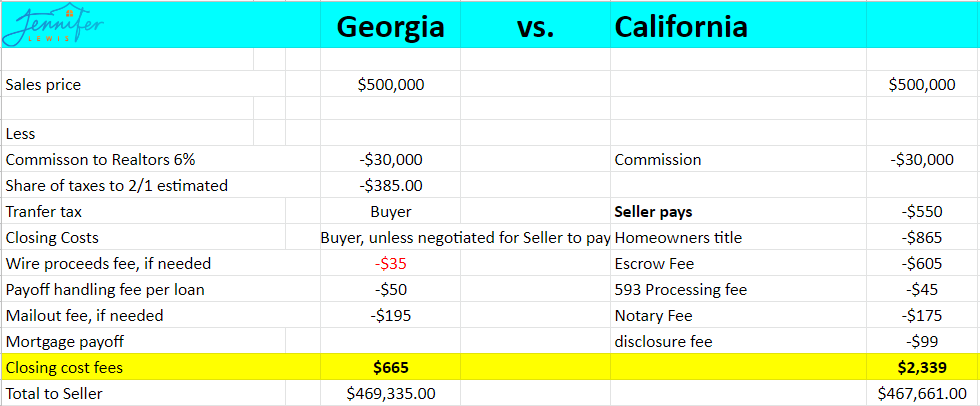

Georgia is a primarily an attorney state because it saves tons of money on title insurance. No title companies want to come in and sell title insurance because there’s no money in it. The prices are set and that’s it. So an attorney does that as part of their process rather than a “title” department and then close with your “escrow” department. See the graph below.

TIPS AND TRICKS FROM A CLOSING ATTORNEY IN GEORGIA

-In Georgia seller pays the seller fees and the buyer pays the buyer fees.

-If you are writing a contract to close on March 31st make sure you are available to be present and close on March 31st.

-Make sure you consider the time difference. If you are not using a local lender make sure they are available to actually close at that time.

-ALWAYS be cautious of wire fraud. Certified funds and personal checks are not accepted. Be careful and if ever in doubt call the office directly and verify the information you have. Independently verify the phone number.

Market update 2023, Is it Better to live in Buford or Peachtree City?, Part 2, how to care for your Georgia Septic tank, Part 1- Georgia Septic is no laughing matter, 10 Things you Must know about homes in Georgia, What you should know about shipping a car to Georgia, Georgia Down payment assistance debunked, Buford Homes Hidden Treasures, Georgia home inspections pass or fail?, Georgia Rent to own homes